Qualified Dividends and Capital Gain Tax Worksheet - Line 44 Form 1040 2009-2026 free printable template

Show details

Capital Loss Carryover Worksheet Lines 6 and 14, Schedule D Use this worksheet to sure capital loss carryovers from 2007 to 2008 if 2007 Schedule D, line 21, is a loss and (a) that loss is a smaller

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 2025 qualified dividends and capital gains worksheet form

Edit your qualified dividends and capital gains worksheet 2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your qualified dividends and capital gains worksheet 2025 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit qualified dividends and capital gain tax worksheet 2025 pdf download online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit qualified dividends and capital gain tax worksheet 2022 pdf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

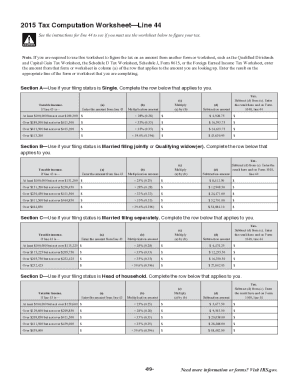

How to fill out qualified dividends and capital gain tax worksheet line 16 2022 form

How to fill out Qualified Dividends and Capital Gain Tax Worksheet

01

Gather your tax documents including Form 1099-DIV, which reports qualified dividends and capital gains.

02

Complete your main tax return form, typically Form 1040, before starting the worksheet.

03

Locate the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for your Form 1040.

04

Begin filling out the worksheet by entering your taxable income from line 15 of Form 1040.

05

Enter the amount of qualified dividends, which you can find on Form 1099-DIV.

06

Next, input any capital gains that are reported on Schedule D or Form 1099-B.

07

Follow the worksheet's steps to calculate your tax based on the qualified dividends and capital gains.

08

Transfer calculated tax amounts to the relevant sections of your Form 1040.

Who needs Qualified Dividends and Capital Gain Tax Worksheet?

01

Taxpayers who have received qualified dividends and capital gains during the tax year.

02

Individuals who meet the income thresholds requiring a different tax rate on their capital gains.

03

Those who want to take advantage of reduced tax rates available for qualified dividends.

Fill

qualified dividends and capital gain tax worksheet 2025

: Try Risk Free

People Also Ask about 2025 1040 line 16 qualified dividends and capital gain work sheet

Is there a 2022 qualified dividends and capital gain tax worksheet?

Who should file the Qualified Dividends and Capital Gain Tax Worksheet 2022? This form is for taxpayers with dividend income. They can use this template if they meet the following requirements: They are not required to file Schedule D; they have reported with capital gain distributions on line 13 of 1040.

Where is the qualified dividends and capital gain tax worksheet?

Qualified Dividends and Capital Gain Tax Worksheet. You reported qualified dividends on Form 1040, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 7. You are filing Schedule D and Schedule D, lines 15 and 16, are both more than zero.

What is the capital gains tax on qualified dividends?

Qualified Dividend Tax Treatment If you make more than $41,675 (single) or $83,350 (joint), you'll have a 15% tax rate on qualified dividends. If your income exceeds this, your capital gains tax will be 15%—at least to the upper threshold of the bracket.

How are qualified dividends taxed 2022?

Your “qualified” dividends may be taxed at 0% if your taxable income falls below $41,676 (if single or Married Filing Separately), $55,801 (if Head of Household), or $83,351 (if (Married Filing Jointly or qualifying widow/widower) (tax year 2022). Above those thresholds, the qualified dividend tax rate is 15%.

How are qualified dividends taxed?

Qualified dividends must meet special requirements issued by the IRS. The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. Ordinary dividends are taxed at income tax rates, which as of the 2023 tax year, maxes out at 37%.

Where is the qualified dividend worksheet?

Qualified Dividends and Capital Gain Tax Worksheet. You reported qualified dividends on Form 1040, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 7. You are filing Schedule D and Schedule D, lines 15 and 16, are both more than zero.

What form is the qualified dividends and capital gain tax worksheet?

The Qualified Dividends and Capital Gain Tax Worksheet (also known as Form 1040–Line 44) is designed to calculate taxes on capital gains at a special rate. Since there is no standard tax rate for all income, each income category should be calculated separately.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2023 qualified dividends and capital gains worksheet pdf without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your capital gains tax worksheet 2021, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit qualified dividends and capital gain tax worksheet 2022 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing qualified dividends and capital gains worksheet 2021.

How do I complete qualified dividends and capital gain tax worksheet on an Android device?

Use the pdfFiller Android app to finish your 2021 qualified dividends and capital gains worksheet and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Qualified Dividends and Capital Gain Tax Worksheet?

The Qualified Dividends and Capital Gain Tax Worksheet is a tax form used by certain taxpayers to calculate their tax liability on qualified dividends and capital gains, allowing them to apply the lower tax rates designated for these types of income.

Who is required to file Qualified Dividends and Capital Gain Tax Worksheet?

Taxpayers with qualified dividends and capital gains that exceed specific thresholds may be required to file the Qualified Dividends and Capital Gain Tax Worksheet to determine the proper tax rates applicable to their income.

How to fill out Qualified Dividends and Capital Gain Tax Worksheet?

To fill out the Qualified Dividends and Capital Gain Tax Worksheet, taxpayers should report their total taxable income, qualified dividends, and capital gains. They must follow the line-by-line instructions provided on the form to calculate their tax liability accurately.

What is the purpose of Qualified Dividends and Capital Gain Tax Worksheet?

The purpose of the Qualified Dividends and Capital Gain Tax Worksheet is to determine the correct tax owed on qualified dividends and capital gains, which are typically taxed at lower rates than ordinary income, ensuring taxpayers are taxed correctly under the laws.

What information must be reported on Qualified Dividends and Capital Gain Tax Worksheet?

The Qualified Dividends and Capital Gain Tax Worksheet requires information such as total income, qualified dividends, and net capital gains, as well as any specific adjustments needed to calculate the tax owed at the applicable rates.

Fill out your Qualified Dividends and Capital Gain Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2025 Qualified Dividends And Capital Gain Tax Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to what form is the qualified category should be calculated separately

Related to qualified dividends and capital gain tax worksheet 2021

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.